Tax on Income of Minor Child

If your Minor Child have some income say Interest from Fixed Deposit than you may be worried as to who will pay the Income Tax on Income of Minor Child and who will file the income tax return ?.

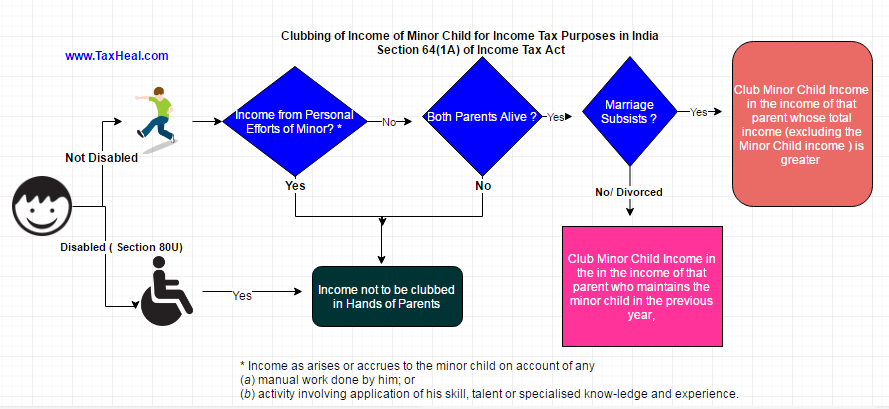

We have explained through Inforgraphics , examples and commentary given below as to who will pay and how the Income Tax will be paid on Minor Child Income.

Inforgraphics relating to Tax on Income of Minor Child

Commentary relating to Tax on Income of Minor Child

- Provisions of Income tax regarding Clubbing of Income of Minor:– As per the provisions of section 64(1A) of the Income-tax Act, 1961, income of a minor child is clubbed with the income of the parent whose total incomeis higher in the first year in which the provisions of section 64(1A) are applied. Therefore, the income of minor is clubbed with the income of mother or father whose income is higher in the first year and thereafter, it continues to be clubbed in the income of the same parent till the minor child attains majority. However, the Assessing Officer may decide to switch over from one parent to other parent in some circumstances.

- No Clubbing if both Parents died :- Read Clubbing of Minor Child Income if Parents Died – CBDT Clarify- Notification No. 5/2017

- How to Club if only one of the Parent died :-

- Income Clubbed :- There have been cases on the issue whether after death of one parent, the marriage subsists or not, the Tribunal has held that even if one spouse dies, it cannot be said that marriage has broken or does not subsist. Furthermore, in case the income of the surviving parent is higher, and income of minor child was clubbed in hands of deceased parent in earlier years, the income of minor child will be clubbed in hands of surviving parent because the marriage subsists even after death of one of parent/spouse and the surviving parent has definitely higher income – Mrs. Rohita Subramanium v. Dy. CIT [2002] 75 TTJ (Mum.) 101. [ refer Explanation b to Section 64(1A)] .

- Income not Clubbed :- In case of death of a parent clubbing is not possible unless it is proved by the revenue that the surviving parent/spouse maintains the child – Smt. Laxmi Agarwal v. Asstt. CIT [2003] 133 Taxman 114 (Luck.) (Mag.).

- Only Net Income is to be Clubbed :- In case of clubbing of income of minor, all deductions are to be allowed while computing income of minor/spouse and only net taxable income is to be clubbed under section 64 . Read clubbing of income of minor child – Gross income or Net Income ?

- No Clubbing of Income if trust created for Minor :- The trust created by the assessee for the benefit of his minor daughter in obedience to the terms of decree of divorce passed against him under the provisions of Parsis Marriage & Divorce Act, 1936, in a suit brought against him by his wife, was for adequate consideration and, therefore, would not fall within the scope of section 64(1)(vii) of the Income-tax Act, 1961. Read No Clubbing of Income if Trust created for minor after Divorce

- Agricultural income of minor— Only total income of minor is to be clubbed in hands of parent. Agricultural income is excluded from income; so agricultural income of minoris not to be clubbed for rate purposes – Smt. Babita P. Kanungo v. Dy. CIT [2005] 96 ITD 91 (Mum.).

- Loss of minor is to be allowed—In Deepchand Bararia v. ITO [2002] 125 Taxman 267 (Hyd.) (Mag.), the Tribunal held that it is impermissible for any of lower authorities to ignore explicit provisions given in Explanation 2 to section 64 and deny benefit of deduction of loss of minor to the assessee in whose hands minor’s income is included. Note : Explanation 2 to section 64 says that for the purpose of this section, income includes loss.

- Whether Child is Assessee :- There is a case in which Tribunals have held that each child is an individual and is also an assessee and is, therefore, free to adopt method of accounting which is different from method of accounting followed by the parent – Bajaj Ashok Chunnilal v. Dy. CIT [2005] 92 ITD 353 (Bang.). In this case, the father claimed interest payable to child on loan taken from him as per mercantile system, whereas in case of minor child, method of cash basis accounting was followed, so that interest not actually received from father was not offered for taxation.

Relevant Section 64(1A) of Income Tax Act relating to Tax on Income of Minor Child

*[(1A) In computing the total income of any individual, there shall be included all such income as arises or accrues to his minor child **[, not being a minor child suffering from any disability of the nature specified in section 80U] :

Provided that nothing contained in this sub-section shall apply in respect of such income as arises or accrues to the minor child on account of any—

(a) manual work done by him; or

(b) activity involving application of his skill, talent or specialised know-ledge and experience.

Explanation.—For the purposes of this sub-section, the income of the minor child shall be included,—

(a) where the marriage of his parents subsists, in the income of that parent whose total income (excluding the income includible under this sub-section) is greater ; or

(b) where the marriage of his parents does not subsist, in the income of that parent who maintains the minor child in the previous year,

and where any such income is once included in the total income of either parent, any such income arising in any succeeding year shall not be included in the total income of the other parent, unless the Assessing Officer is satisfied, after giving that parent an opportunity of being heard, that it is necessary so to do.]

* Section 64(1A) Inserted by the Finance Act, 1992, w.e.f. 1-4-1993.

** Inserted by the Finance Act, 1994, w.e.f. 1-4-1995.