Tax paid on Goods before GST but received after GST Act

Implication For Dealers who Have Paid Tax Before Appointed Day But Will Receive Goods After Appointed Day

As per Section 140(5) of CGST Act

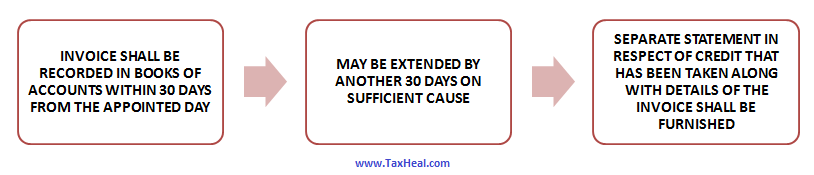

A registered person shall be entitled to take, in his electronic credit ledger, credit of eligible duties and taxes in respect of inputs or input services received on or after the appointed day but the duty or tax in respect of which has been paid by the supplier under the existing law, subject to the condition that the invoice or any other duty or tax paying document of the same was recorded in the books of account of such person within a period of 30 days from the appointed day:

Note that the period of 30 days may, on sufficient cause being shown, be extended by the Commissioner for a further period not exceeding 30 days:

Registered person shall furnish submit a declaration electronically in FORM GST TRAN- 1 duly signed, on the Common Portal specifying therein,details of credit that has been taken .

And Rule 1(2)(C) Of GST Transition Rules , the details shall include the followings :-

(i) the name of the supplier, serial number and date of issue of the invoice by the supplier or any document on the basis of which credit of input tax was admissible under the existing law,

(ii) the description and value of the goods or services,

(iii) the quantity in case of goods and the unit or unit quantity code thereof,

(iv) the amount of eligible taxes and duties or, as the case may be, the value added tax [or entry tax] charged by the supplier in respect of the goods or services, and

(v) the date on which the receipt of goods or services is entered in the books of account of the recipient.