Revised TDS Rates and Limit w.e.f 01.06.2016

Finance Act 2016 has revised TDS Rates and limit for Rationalization of tax deduction at Source (TDS)

Under the scheme of deduction of tax at source as provided in the Act, every person responsible for payment of any specified sum to any person is required to deduct tax at source at the prescribed rate and deposit it with the Central Government within specified time. However, no deduction is required to be made if the payments do not exceed prescribed threshold limit.

In order to rationalise the rates and base for TDS provisions, the threshold limit for deduction of tax at source and the rates of deduction of tax at source have been revised with effect from 1-6-2016 as mentioned in Table 1 and Table 2 respectively.Certain non-operational provisions to be omitted w.e.f 01.06.2016 as mentioned in Table 3

Table 1: Increase in threshold limit of deduction of tax at source on various payments mentioned in the relevant sections of the Act

[table id=25 /]

Table-2 : Revision in rates of deduction of tax at source on various payments mentioned in the relevant sections of the Act:

[table id=26 /]

Table -3 :Certain non-operational provisions to be omitted w.e.f 01.06.2016

[table id=27 /]

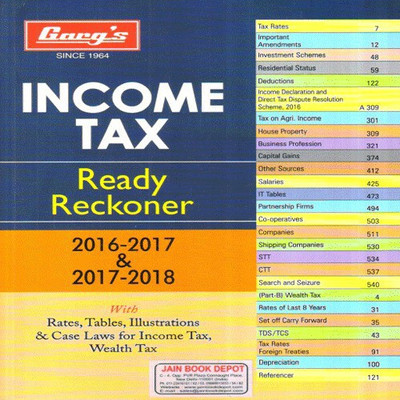

Sponsored Book

1. The amendment is effected in Entry 1(a)(iv) of Part II of First Schedule specifying the rate of deduction of tax at source in case of a person other than a company on income by way of commission.

Related Post

- No TDS on Service Tax Component of Rent

- No TDS on leasehold rights payment for long period say 99 years

- TDS on Payment to harvester / transporter of Sugarcane from Farmers field

- No TDS on Provision of Interest u/s194A if provision reversed

- TDS statement due date of filing w.e.f 01.6.2016

- TDS Statement Upload Online -Procedure

- Penalty for Not filing TDS Return

- e-TDS / TCS returns through e-filing portal https://incometaxindiaefiling.gov.in

- TDS recovery can be made at any time from Defaulter

- Delay in filing TDS returns due to the non furnishing of PAN by deductees is reasonable cause

- Penalty for delay in filing TDS return

- Download Form 16 for TDS on salary

- TDS on Property , Govt revised timeline to Deposit

- Interest on refund of excess TDS Depoisted u/s 195 can’t be denied : CBDT

- Deductors to validate Lower TDS certificates given by Deductee

- TDS on Purchase of Property : FAQ’s

- 26QB online correction enabled by CPC TDS

- Online Correction Facility for 26QB enabled (TDS on sale of property)