The Blocking/Unblocking of E-Way Bill generation

Dated: 12-11-2019

E-Way Bill system will have a new feature of blocking/unblocking of the taxpayers from next month, as per the rule. That is, if the GST taxpayer has not filed Return 3B for the last two successive months in GST Common portal, then that GSTIN will be blocked for generation of e-way bill either as consignor or consignee.

Now, this month, the tax payer will be alerted with a cautionary message while generating the eWaybills, in case Return 3B for the past 2 successive months of the consignor/consignee GSTIN has not been filed. However, from next month onwards, such GSTINs will be blocked.

On Filing of the Return-3B in the GST Common Portal, the GSTIN will get automatically updated as ‘Unblock’ within a day in the e-Waybill system and the tax payer can continue with e-way bill

generation without any cautionary message.

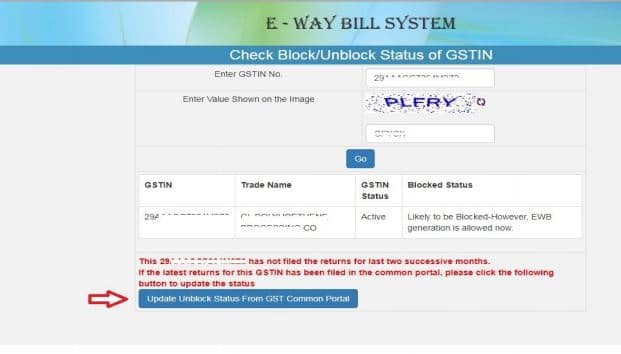

However, if the status is not updated in e-waybill system, then the taxpayer can do it by going to the

e-Waybill portal and clicking on option Search-> Update Block Status. Enter the GSTIN, followed by the CAPTCHA and click on GO.

As shown in the above figure, the GSTIN and the blocked status will be displayed. The user must

now click on the button: ‘Update Unblock Status from GST Common Portal’. This will fetch the

status of filing from the GST Common Portal and if filed, the status in e-Waybill system will

subsequently get updated.

In case the user hasn’t filed the Returns for the last two successive months and clicked on the

update button, a pop-up message as shown below will appear.