‘HIGH LEVEL COMMITTEE ON BANKING FOR VIKSIT BHARAT’ TO ALIGN FINANCIAL SECTOR WITH INDIA’S NEXT PHASE OF GROWTH: UNION BUDGET 2026-27

GOVERNMENT TO RESTRUCTURE THE POWER FINANCE CORPORATION AND RURAL ELECTRIFICATION CORPORATION TO ACHIEVE SCALE AND IMPROVE EFFICIENCYUNION BUDGET PROPOSES A MARKET MAKING FRAMEWORK WITH SUITABLE ACCESS TO FUNDS AND DERIVATIVES ON CORPORATE BOND INDICES

TO ENCOURAGE THE ISSUANCE OF MUNICIPAL BONDS OF HIGHER VALUE, INCENTIVE OF ₹100 CRORE FOR A SINGLE BOND ISSUANCE OF MORE THAN ₹1000 CRORE

INDIVIDUAL PERSONS RESIDENT OUTSIDE INDIA TO BE PERMITTED TO INVEST IN EQUITY INSTRUMENTS OF LISTED INDIAN COMPANIES THROUGH THE PORTFOLIO INVESTMENT SCHEME

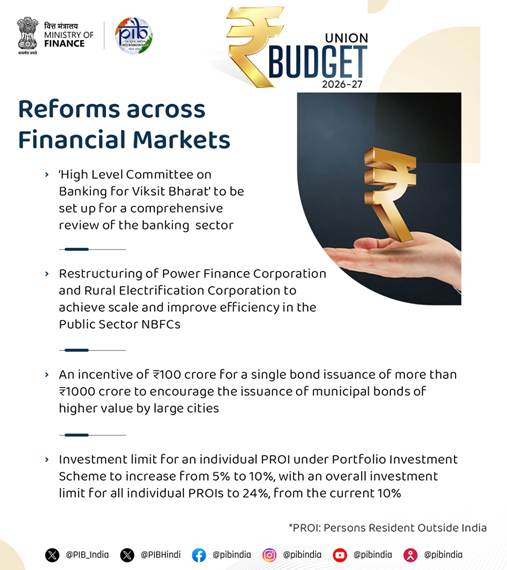

The Union Budget 2026-27 proposes to set up a ‘High Level Committee on Banking for Viksit Bharat’. Presenting the Union Budget in Parliament today, the Union Minister of Finance and Corporate Affairs Smt. Nirmala Sitharaman said that it will comprehensively review the financial sector and align it with India’s next phase of growth, while safeguarding financial stability, inclusion and consumer protection. Indian banking sector today is characterised by strong balance sheets, historic highs in profitability, improved asset quality and coverage exceeding 98% of villages in the country, the Union Budget noted.

The Union Budget proposes to restructure the Power Finance Corporation and Rural Electrification Corporation to achieve scale and improve efficiency in the Public Sector NBFCs. The vision for NBFCs for Viksit Bharat has been outlined with clear targets for credit disbursement and technology adoption.

Smt. Nirmala Sitharaman proposes a comprehensive review of the Foreign Exchange Management (Non-debt Instruments) Rules in the Union Budget to create a more contemporary, user-friendly framework for foreign investments consistent with India’s evolving economic priorities.

The Union Budget 2026-27 also proposes for a market making framework with suitable access to funds and derivatives on corporate bond indices along with a proposal for total return swaps on corporate bonds.

To encourage the issuance of municipal bonds of higher value by large cities, the Union Budget proposes an incentive of ₹100 crore for a single bond issuance of more than ₹1000 crore. The current scheme under AMRUT which incentivises issuances up to ₹200 crore, will also continue to support smaller and medium towns.

To enhance ease of doing business, Individual Persons Resident Outside India (PROI) will be permitted to invest in equity instruments of listed Indian companies through the Portfolio Investment Scheme. The Union Budget also proposes to increase the investment limit for an individual PROI under this scheme from 5% to 10%, with an overall investment limit for all individual PROIs to 24%, from the current 10%.