How to download 26AS from Traces

There are three ways to download 26AS from Traces

- Download 26AS from Traces through Income Tax Department website

Download 26AS from Traces through TDS CPC website

Download 26AS from Traces through Net Banking facility ( No need for any login ID or Password of Traces or Income Tax website)

What is Form 26AS ?

Form 26AS is a consolidated tax statement that shows all the taxes deducted or collected at source on your income. You can download Form 26AS from TRACES website or using netbanking facility of authorized banks .

The following details have been provided in 26AS statement:

- Advance tax, Self-Assessment Tax and Regular Assessment Tax paid by self

- Tax paid through Tax Deducted at Source (TDS) or TCS on behalf of users own presence

- Refund issued by the Department to self

- Information received from various agencies on high value transaction carried by self.

This statement is presented yearly, which reflects the transaction of the concerned year.

How to Download 26AS from Traces through Income Tax Department website ?

Perform the following steps to view or download the form:

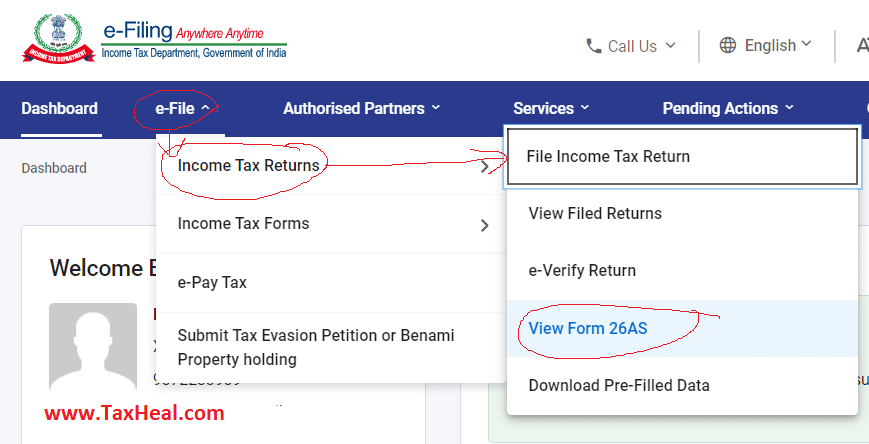

| Step 1 | Logon to the ‘e-Filing’ Portal https://www.incometax.gov.in/iec/foportal/ |

| Step 2 | Go to the ‘efile ‘ menu located at upper-left side of the page ⇒ Click Income Tax Return : then Click ‘View Form 26 AS ‘ , User is redirected to TDS-CPC Portal |

| Step 3 | View the disclaimer ⇒ Click ‘Confirm’ ⇒ Agree the acceptance of usage ⇒ Click ‘Proceed’ |

| Step 4 | Click ‘View Tax Credit (Form 26AS)’ |

| Step 5 | Select the ‘Assessment Year’ and ‘View type’ (HTML, Text or PDF) |

| Step 6 | Click ‘View / Download’ |

How to Download 26AS from Traces through TDS CPC website ?

To download Form 26AS from TRACES website, you need to login with your user ID and password and follow these steps

- Login to Traces website as Taxpayer using user ID and Password . If you are not resitered on Traces website then first you needs to register as Taxpayer . ( User ID is your PAN)

- Click on “View Tax Credit (Form 26AS)” tab

- Click on “View Form 26AS”

- Select “Assessment Year” and “Format” for downloading 26AS

- Enter the verification code and click on “View/Download”

How to Download 26AS from Traces through Net Banking facility ?

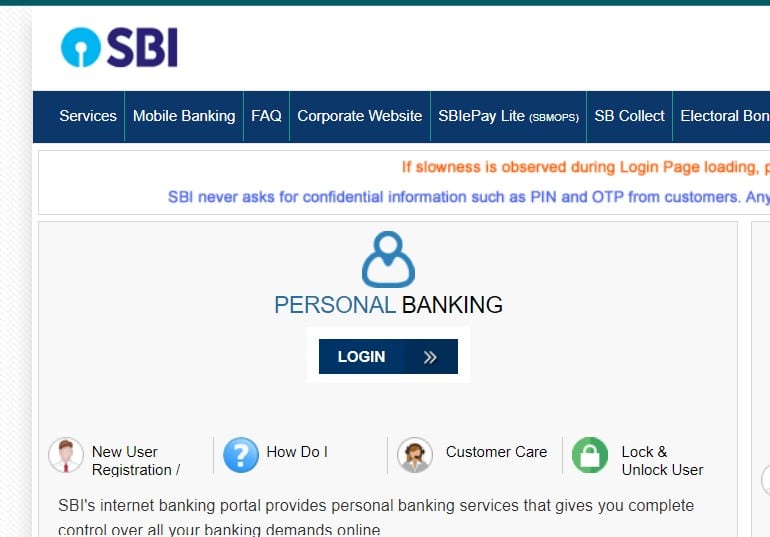

- Login to your bank Account online with your Net Banking facility (like SBI, ICICI bank etc )

- Find out option to login to efiling website . In case of SBI bank, this option is under “EPAY Tax”

- You will be redirected to Income Tax website and you will be automatically logged in without any password and user ID .

- Go to the ‘efile ‘ menu located at upper-left side of the page ⇒ Click Income Tax Return : then Click ‘View Form 26 AS ‘ , User is redirected to TDS-CPC Portal

- View the disclaimer ⇒ Click ‘Confirm’ ⇒ Agree the acceptance of usage ⇒ Click ‘Proceed’

- Click ‘View Tax Credit (Form 26AS)’

- Select the ‘Assessment Year’ and ‘View type’ (HTML, Text or PDF)

- Click ‘View / Download’

Income Tax Return : Free Study Material

Income Tax TDS Certificates : Free Study Material

Income Tax Efiling Website : Free Study Material

Other Study Material on 26AS

Circular No 01/2018 : Processing of income-tax returns under section 143(1) :Mismatch 26AS /16A

How to rectify if Income Tax Paid / TDS deducted not appearing in 26AS (Tax Credit ) Statement

Why Income Tax Paid / TDS deducted not appearing in 26AS (Tax Credit ) Statement

Income Tax Officer can check Returns & 26AS of Assessee of any Jurisdiction

No addition 26AS basis if payee claimed there was wrong entry in TDS return: ITAT

IDS Information will not be shown in 26AS or To Assessing Officer

All About 26AS (TDS, Refund , AIR information )

TDS on Rent of Property : Section 194IB: FAQs : Form 26QC & Form 16C

Income Tax India Help Desk Number / Income Tax India e-Filing Helpline Numbers

This Article is useful on following search terms

form 26as,26as,form 26as download,what is form 26as,how to download form 26as,form 26as download pdf,26as for income tax,how to download 26as,form 26as kya hota hai,how to view form 26as,check form 26as,what is 26as in tds,how to use form 26as,26as download,form 26as explanation,reconcile 26as,view 26as,26as view,check 26as,download form 26as,what is 26as,traces 26as,income tax form 26as,online 26as download,tds form 26as