ORDER

Prathiba M. Singh, J. – This hearing has been done through hybrid mode.

2. The present petition has been filed by the Petitioner- M/s Jai Optical under Article 226 and 227 of the Constitution of India, inter alia, assailing the impugned order dated 8th January 2025 (hereinafter, ‘impugned order’) and impugned show cause notices dated 24th September 2023 and 30th May 2024.

3. The Petitioner has challenged the repeated issuance of show cause notices by the Delhi Goods and Service Tax Department (hereinafter, ‘Department’) and challenges the impugned order on the ground that despite a specific reply having been placed on record that the Petitioner was suffering from a stroke, the Department proceeded and passed the impugned order.

4. In this case, there are three SCNs which were issued. In the show cause notice dated 24th September, 2023, an order dated 29th November, 2023 was passed. The same was challenged in W.P. (C) 3823/2024 titled ‘Jai Optical v. Govt. of NCT of Delhi & Ors.’ wherein the Coordinate Bench of this Court passed the following order:

“8. The observation in the impugned order dated 29.11.2023 is not sustainable for the reasons that the reply filed by the petitioner is a detailed reply, however the impugned order records that “neither filed any reply nor appeared in person”. Proper Officer had to at least consider the reply submitted by the Petitioner on merits and then form an opinion. He merely held that the no reply has been filed which ex-facie shows that Proper Officer has not applied his mind to the reply submitted by the petitioner.

9. In view of the above, the order cannot be sustained, and the matter is liable to be remitted to the Proper Officer for re-adjudication. Accordingly, the impugned order dated 29.11.2023 is set aside. The matter is remitted to the Proper Officer for re-adjudication.

10. As noticed hereinabove, the impugned order records that petitioner has not filed any reply or appeared for personal hearing. Proper Officer is directed to intimate to the petitioner details/documents, as maybe required to be furnished by the petitioner. Pursuant to the intimation being given, petitioner shall furnish the requisite explanation and documents. Thereafter, the Proper Officer shall re-adjudicate the Show Cause Notice after giving an opportunity of personal hearing and shall pass a fresh speaking order in accordance with law within the period prescribed under Section 75(3) of the Act. “

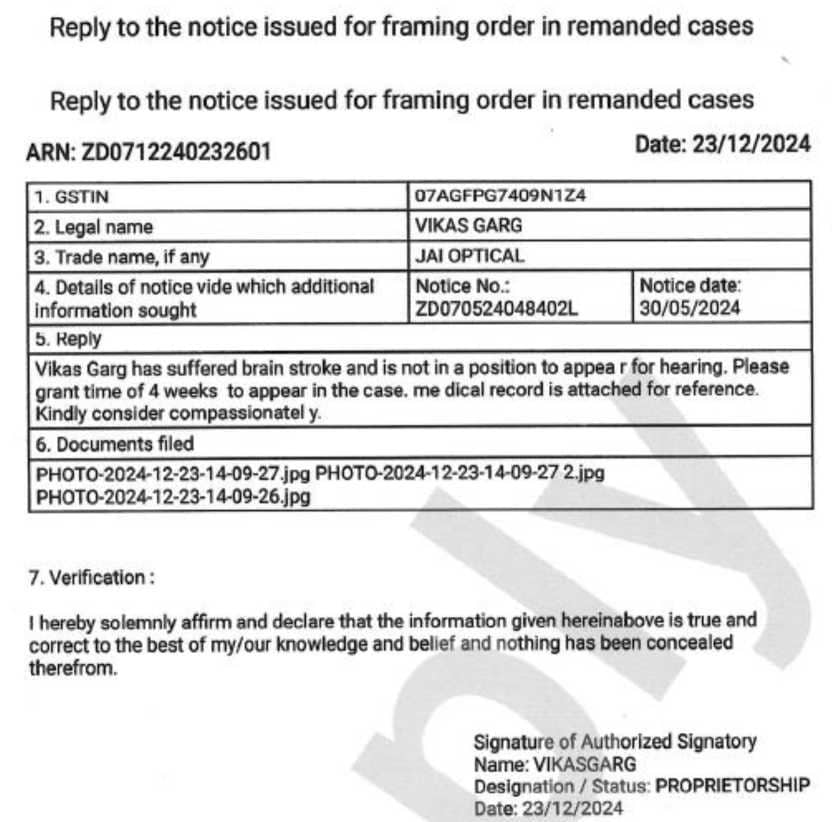

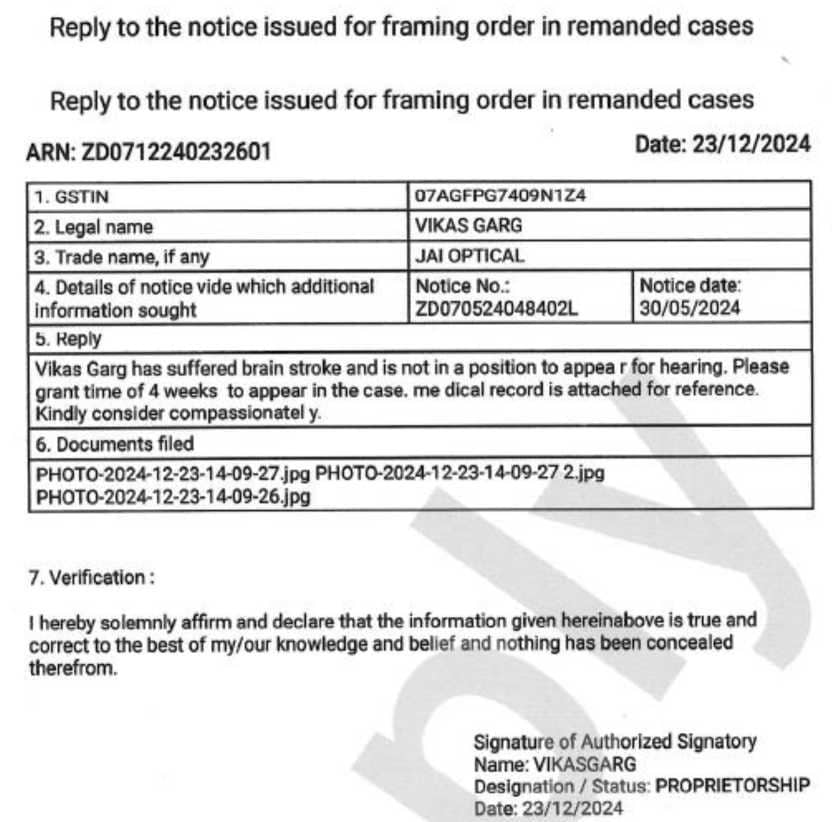

5. Subsequent to this, instead of giving a fresh hearing to the Petitioner, a second show cause notice dated 3rd May, 2024 was issued. The reply to the same was filed by the Petitioner on 16th May, 2024 and the demand was dropped on 5th June, 2024. Thereafter, a third show cause notice was issued on 30th May, 2024 in respect of which a reply was filed by the Petitioner on 30th May, 2024. A hearing notice is fixed in this matter on 3rd December, 2024. However, an adjournment was sought by the Petitioner by filing a reply on 23rd December, 2024 to the following effect:

6. As can be seen from the above reply, the Petitioner had sought an adjournment on the ground that Mr. Vikas Garg the Petitioner’ s proprietor had suffered a brain stroke and was not in a position for a hearing. Instead of considering the adjournment request, the Department passed the impugned order on 8th January, 2025 raising a demand of approximately Rs.1.5 crores. 7. The submission on behalf of the Petitioner is that the Petitioner has always been diligent and has been following up with the Department. The Petitioner has also been filing replies despite this being the position. Ld. Counsel submits that only due to medical grounds, the adjournment was sought and the same was not granted and the impugned order has been passed. 8. Ms. Gupta, ld. Counsel for the Respondent submits that the second and the third show cause notices are merely in continuation of the first show cause notice. Since the second show cause notice was uploaded on a wrong tab the same was dropped and a third show cause notice was issued.

9. Considering the overall facts, there is no doubt that the Petitioner has been continuously following up with the Department and filing replies diligently. The medical ground which was stated on 23nd December, 2024 ought to have been considered emphathetically as the same was accompanied with all the documents from Indraprastha Apollo Hospital.

10. When such requests for adjournment are made on the medical grounds, obviously the Department is expected to consider the same and not proceed to pass orders.

11. In this view of the matter, the impugned order dated 8th January, 2025 is set aside.

12. The Petitioner shall be afforded a hearing. The hearing notice shall be communicated to the Petitioner on the portal and after hearing the Petitioner, orders shall be passed in accordance with law.

13. This Court has not examined the merits of the matter.

14. The petition is disposed of in these terms. All pending applications, if any, are also disposed of.