Parallel GST Proceedings Barred: State Demand Order Set Aside and Remanded Due to Prior Central Adjudication.

Issue:

Whether parallel proceedings initiated by the State Goods and Services Tax (SGST) Department on a subject matter already adjudicated by the Central Goods and Services Tax (CGST) Department are permissible under the GST law, specifically contravening Section 6(2)(b) of the CGST Act, 2017.

Facts:

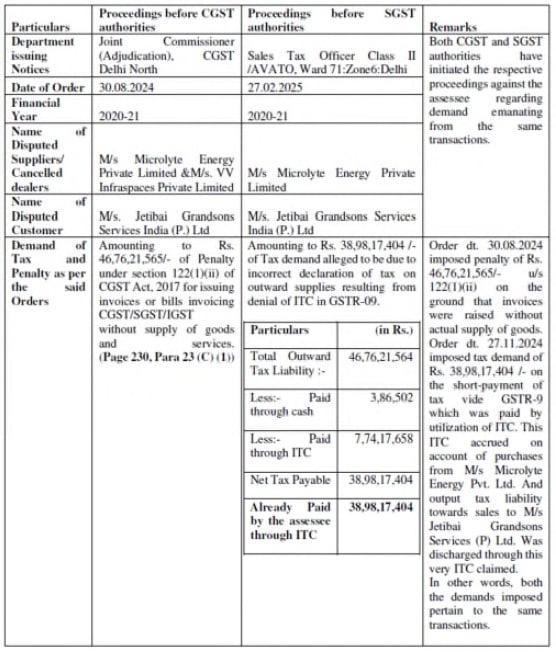

A Show Cause Notice (SCN) dated November 27, 2024, was issued by the respondent no. 1 (State Department) to the petitioner-assessee concerning certain transactions. Subsequently, respondent no. 1 passed an order dated February 27, 2025, raising a demand of Rs. 157.66 crores against the petitioner. However, the same matter had already been adjudicated by the CGST Department. Furthermore, an appeal filed by the petitioner against the CGST demand was rejected by respondent no. 2 (appellate authority), which imposed a penalty on the petitioner via an order dated April 3, 2025. The petitioner filed a writ petition challenging the SCN and order issued by the State Department on the ground of impermissible parallel proceedings.

Decision:

In favor of the assessee (Matter remanded): The court held that Section 6(2)(b) of the CGST Act explicitly bars parallel proceedings by both CGST and SGST officers on the same subject matter. Citing the precedent in Amit Gupta v. Union of India & Ors. (though the specific citation provided in the user’s input might be an older/different context related to anticipatory bail, the principle of parallel proceedings being barred is widely upheld by courts including the Delhi High Court in other GST contexts), it was affirmed that parallel proceedings violate Section 6(2)(b).

In the instant case, the court ruled that respondent no. 1 (State Department) was required to consider the appellate order dated April 3, 2025, passed by respondent no. 2 (CGST appellate authority) before passing its impugned order. Therefore, in view of the above facts and established legal principles, the impugned order issued by the State Department was set aside. The matter was remanded back to respondent no. 1 for fresh consideration, taking into account the CGST appellate order and granting a personal hearing to the assessee.

Key Takeaways:

- Prohibition of Parallel Proceedings (Section 6(2)(b)): Section 6(2)(b) of the CGST Act is a crucial provision designed to prevent harassment and duplication of efforts by ensuring that once a proper officer under either the Central GST Act or the State/UT GST Act has initiated proceedings on a subject matter, no proceedings shall be initiated by the proper officer under the other Act on the same subject matter. This promotes administrative efficiency and protects taxpayers from facing multiple demands for the same alleged default.

- Coordination Between Central and State GST Authorities: The dual GST model in India necessitates strong coordination between central and state tax authorities. This judgment underscores the need for one authority to defer to the other if proceedings on the same subject matter have already commenced or concluded.

- Impact of Prior Adjudication: If a matter has already been adjudicated by one tax authority (e.g., CGST), the other authority (e.g., SGST) should not proceed with parallel proceedings on the identical subject matter, especially when an appellate order from the first proceeding exists. The subsequent authority should consider the outcome of the prior adjudication.

- Principle of Natural Justice: The directive to grant a personal hearing on remand reinforces the fundamental principle of natural justice, ensuring that the assessee has a fair opportunity to present their case.

- Consequence of Violation: Orders passed in violation of the prohibition on parallel proceedings are liable to be set aside, and the matter may be remanded for fresh consideration in light of the prior proceedings.

CM APPL. 26164 of 2025

| (b) | where a proper officer under the State Goods and Services Tax Act or the Union Territory Goods and Services Tax Act has initiated any proceedings on a subject matter, no proceedings shall be initiated by the proper officer under this Act on the same subject matter. |