ORDER

1. This hearing has been done through hybrid mode.

2. The present petition has been filed under Article 226 of the Constitution of India, 1950 seeking to quash order dated 28th January, 2025 passed by the Respondent-Assistant Commissioner, Division MCIE, CGST Delhi East Commissionerate (hereinafter ‘Department’) confirming demand of Input Tax Credit of Rs. 34,92,903/- availed without receipt of goods along with equivalent penalty and appropriate interest.

3. The grievance in this case is that the personal hearings were fixed on 13th, 14th and 15th January, 2025. Ld. Counsel for the Petitioner submits that he joined the link on 15th January, 2025 at 12:00 PM, however, he was not granted access to attend the hearing.

4. A perusal of the record would show that there are two show cause notices dated 22nd July, 2022 and 3rd August, 2024 which have been issued. No reply to the Show Cause Notice dated 3rd August, 2024 was filed by the Petitioner even after the notice for personal hearing, which was sent on 8th January, 2025.

5. Further it is also noticed that the said notice of personal hearing provided three dates of hearing

i.e., 13

th, 14

th and 15

th January,

2025. The Petitioner sought to join only on 15

th January,

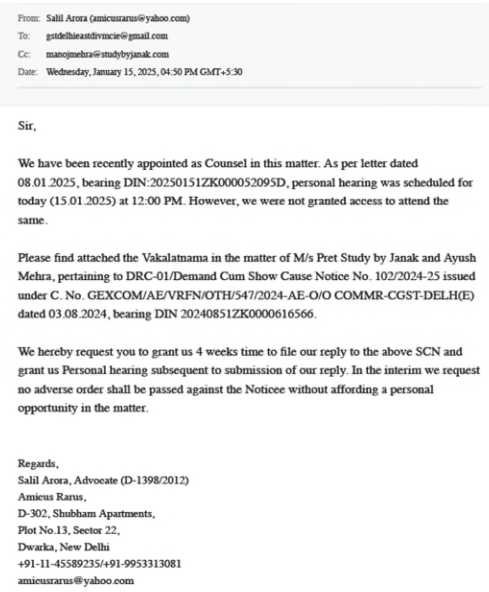

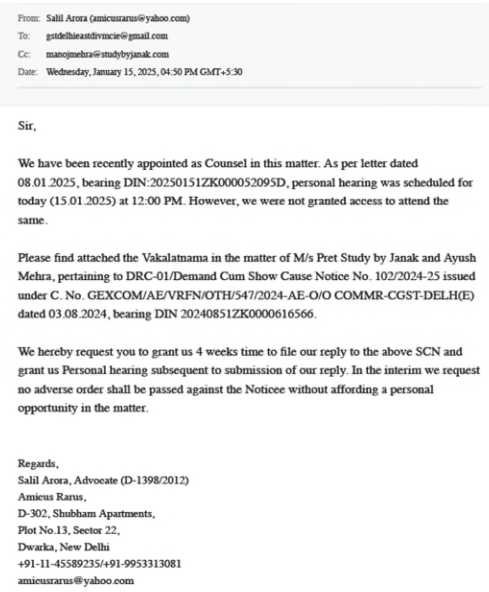

2025 for the purposes of seeking an extension. This can be seen from the email sent by the ld. Counsel of the Petitioner which reads as under:

6. From the above, it is clear that no reply was also filed to the show cause notice even after the alleged access to the personal hearing was not granted. Beyond that, no effort was made by the Petitioner to either file the reply or file the documents physically or otherwise. The order has been passed on 28th January, 2025 almost two weeks after the date of personal hearing. From the above circumstances itis clear that the Petitioner has not been diligent in filing the reply and attending the hearings.

7. A perusal of the order would show that the demand of wrongfully availed Input Tax Credit is confirmed along with interest. Penalty to the tune of Rs. 34,92,903/- has been imposed on the Petitioner in the following terms:

| (i) | | I confirm the demand of Input Tax Credit of Rs. 34,92,903/- availed/ utilized without receipt of goods by the notice under Section 74(1) of the CGST Act, 2017 read with Section 74(1) of the Delhi GST Act, 2017 and Section 20 ofIGST Act, 2017. |

| (ii) | | I confirm the demand of Interest under the provisions of Section 50 of the CGST Act, 2017 and relevant mirror provisions ofDGSTAct, 2017 and Section 20 of IGST ACT, 2017 and order to recover the same from the noticee on the amount as mentioned at S.No. (i) above. |

| (iii) | | I impose penalty of Rs. 34,92,903/- on the noticee under Section 74 read with Section 122(2)(b) and Section 122 (l)(vii) of CGST Act, 2017 read with mirror provisions ofDGSTACT, 201 7 and Section 20 of IGST Act, 2017 for the reason discussed supra and order to recover the same |

| (v) | | I impose Penalty of Rs. 25,000 /- on the director of the company Sh. Ayush Mehra under section 122(3)(d) read with relevant mirror provisions of Delhi GST Act, 2017 and Section 20 of IGST Act 2017 for the reason discussed supra and order to recover the same. |

| (vi) | | I impose Penalty amounting Rs 25,000 on the director of the company Sh. Ayush Mehra under Section 125 of the CGST Act, 2017 read with relevant mirror provisions of Delhi GST Act, 2017 and section 20 of IGST Act 2017 for the reason discussed supra and order to recover the same. |

8. The above order is clearly an appealable order under Section 107 of the Central Goods and Service Tax Act, 2017. Considering the fact that

| (i) | | The Department has given the show cause notice and the personal hearing notices to the Petitioner; |

| (ii) | | The Petitioner has not been diligent; the Department cannot be held to blame for not giving a proper hearing. |

9. Under these circumstances, the impugned Order, in the opinion of the Court, does not warrant interference.

10. The petition is disposed of with the liberty to the Petitioner to avail its appellate remedies within 30 days along with the pre-deposit. If the same is filed within the time stipulated, the concerned appellate authority shall not dismiss the appeal on the ground of limitation and shall decide the appeal on merits.

11. The present petition is disposed of in the above terms. Pending application(s), if any, also stand disposed of.