Non-Diligence in Checking GST Portal: Assessee Directed to Appeal Despite Wrong Tab Upload

Issue: Whether an order passed based on a Show Cause Notice (SCN) uploaded under the ‘additional notices and orders’ tab instead of the ‘notices and orders’ tab on the GST portal, coupled with the assessee’s alleged inability to access the portal and failure to reply to a reminder, warrants setting aside the order or directing the assessee to appeal.

Facts:

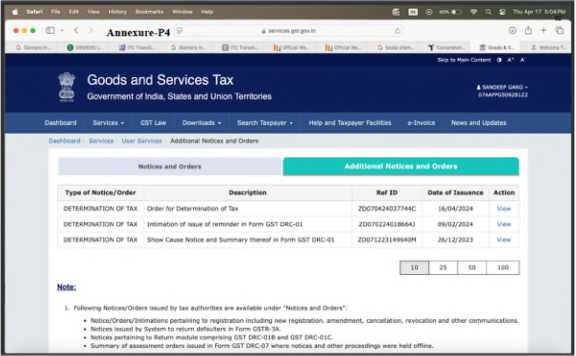

- The Department issued an SCN on the GST portal, but it was placed under the ‘additional notices and orders’ tab instead of the standard ‘notices and orders’ tab.

- A reminder notice was subsequently given in the matter, but the assessee failed to file a reply.

- The assessee contended that their accountant could not access the portal as it was not working at that time, preventing them from filing a reply.

- The Department argued that the assessee had not been diligent in checking the portal.

Decision: The court acknowledged that the assessee had not been diligent in checking the portal and therefore, the Department could not be entirely blamed. However, considering the specific facts and circumstances of the case, the assessee was permitted to file an appeal under Section 107 of the CGST/DGST Act.

Key Takeaways:

- Assessee’s Diligence Expected: While the Department has a duty to ensure proper service, assessees are also expected to be diligent in regularly checking the designated tabs on the GST portal for communications. The court implied that technical issues with the portal should be promptly reported or alternative means of communication explored if access is genuinely hindered.

- Impact of Reminder Notice: The issuance of a reminder notice by the Department weakens the assessee’s argument of complete lack of knowledge, as it indicates a further attempt to communicate.

- Balance of Equities: The court struck a balance by not outright setting aside the order (as in previous cases where no reminder was given or the assessee had no knowledge), but by still providing the assessee with an opportunity to present their case through the appellate mechanism.

- Appellate Remedy as Appropriate Forum: When there are factual disputes (e.g., regarding portal access or diligence) or a need for a detailed review of the case on merits, directing the assessee to the appellate authority is often considered the appropriate course of action.

- Partial Relief: This decision is partly in favor of the assessee as it grants them the opportunity to pursue their case further, rather than dismissing it outright due to their non-diligence.

CM APPLs. No. 26721 and 26722 OF 2025