Notification No 32/2017 Central Tax

Seeks to granting exemption to a casual taxable person making taxable supplies of handicraft goods from the requirement to obtain registration vide Notification No 32/2017 Central Tax Dated 15th September, 2017

[ Seeks to amend notification no. 32/2017-CT dated 15.09.2017 so as to add certain items to the list of “handicrafts goods” vide Notification No 38/2017 Central Tax Dated 13th October 2017

Seeks to amend notification No. 11/2017-CT(R) so as to reduce rate of job work on “handicraft goods” @ 2.5% and to substitute “Services provided” in item (vi) against Sl No. 3 in table. vide Notification No 46/2017 Central Tax (Rate) Dated 14th November, 2017 ]

[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i)]

Government of India

Ministry of Finance

Department of Revenue

Central Board of Excise and Customs

Notification No. 32/2017 – Central Tax

New Delhi, the 15th September, 2017

G.S.R. (E).—In exercise of the powers conferred by sub-section (2) of section 23 of the Central Goods and Services Tax Act, 2017 (12 of 2017), the Central Government, on the recommendations of the Council, hereby specifies the casual taxable persons making taxable supplies of handicraft goods as the category of persons exempted from obtaining registration under the aforesaid Act:

Provided that the aggregate value of such supplies, to be computed on all India basis, does not exceed an amount of twenty lakh rupees in a financial year:

Provided further that the aggregate value of such supplies, to be computed on all India basis, does not exceed an amount of ten lakh rupees in case of Special Category States, other than the State of Jammu and Kashmir

2. The casual taxable persons mentioned in the preceding paragraph shall obtain a Permanent Account Number and generate an e-way bill in accordance with the provisions of rule 138 of the Central Goods and Services Tax Rules, 2017.

3. The above exemption shall be available to such persons who are making inter-State taxable supplies of handicraft goods and are availing the benefit of notification No. 8/2017 – Integrated Tax dated the 14th September, 2017 published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R. 1156(E), dated the 14th September, 2017.

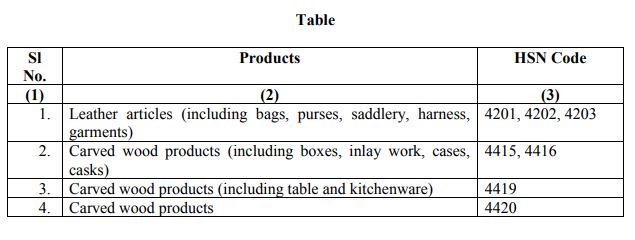

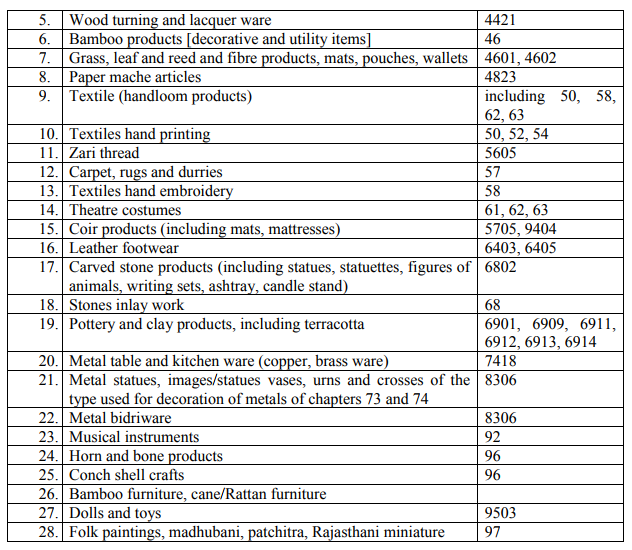

Explanation – For the purposes of this notification, the expression “handicraft goods” means the products mentioned in column (2) of the Table below and the Harmonized System of Nomenclature (HSN) code mentioned in the corresponding entry in column (3) of the said Table, when made by the craftsmen predominantly by hand even though some machinery may also be used in the process:-

[F. No. 349/58/2017-GST(Pt.)]

(Dr.Sreeparvathy.S.L.)

Under Secretary to the Government of India

Download Notification in PDF from CBEC Website

Related Topic on GST

| Topic | Click Link |

| GST Acts | Central GST Act and States GST Acts |

| GST Rules | GST Rules |

| GST Forms | GST Forms |

| GST Rates | GST Rates |

| GST Notifications | GST Act Notifications |

| GST Circulars | GST Circulars |

| GST Judgments | GST Judgments |

| GST Press Release | GST Press Release |

| GST Books | Best Books on GST in India |

| GST Commentary | Topic wise Commentary on GST Act of India |

| GST You Tube Channel | TaxHeal You Tube Channel |

| GST Online Course | Join GST online Course |

| GST History | GST History and Background Material |