GST Revenue collection for the month of June, 2019 stands at Rs.99,939 crore

Total number of GSTR 3B Returns filed for the month of May up to 30th June, 2019 stands at 74.38 lakh

Total gross GST revenue collected in the month of June, 2019 is ₹ 99,939croreof which CGST is ₹ 18,366crore, SGST is ₹ 25,343crore, IGST is ₹ 47,772crore (including ₹ 21,980crore collected on imports) and Cess is ₹8,457 crore (including ₹ 876crore collected on imports). The total number of GSTR 3B Returns filed for the month of Mayup to 30th June, 2019 is 74.38lakh.

The Government has settled ₹ 18,169 crore to CGST and ₹ 13,613 crore to SGST from IGST as regular settlement. The total revenue earned by Central Government and the State Governments after regular settlement in the month of June, 2019 is ₹ 36,535 crore for CGST and ₹ 38,956 crore for the SGST.

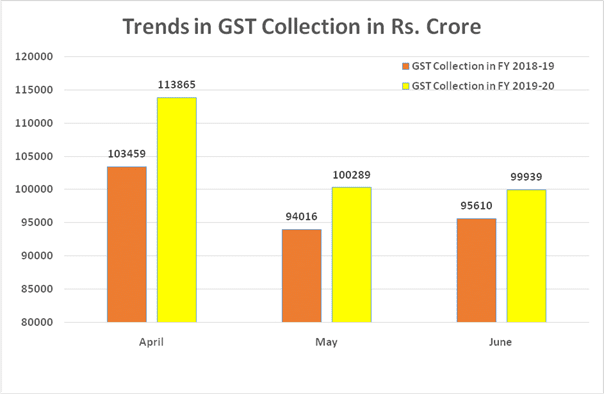

Revenue in June, 2018 was ₹ 95,610 crore and the revenue during June, 2019 is a growth of 4.52% over the revenue in the same month last year. The revenue in June, 2019 is 1.86% higher than the monthly average of GST revenue in FY 2018-19 (₹ 98,114 crore).

The chart shows trends in revenue during the current year.

Refer GST Revenue Collection : till date