GST Return

Who … What….When….How to File GST Return

| Sr.No | Form | Who to File ? | What to file? | When to File ? |

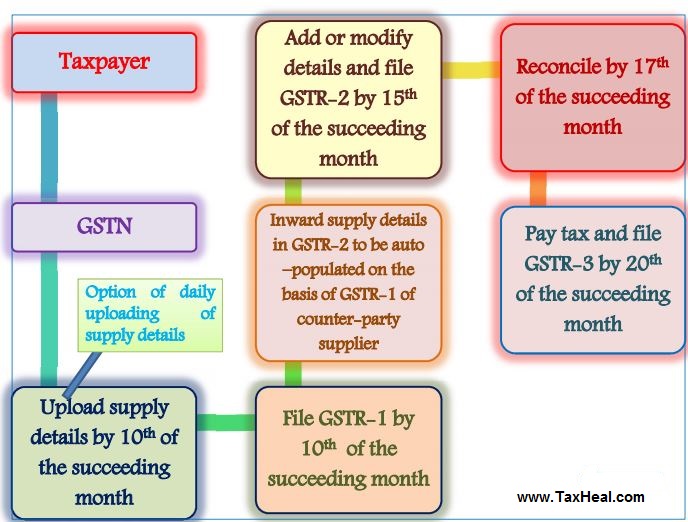

| 1 | GSTR-1 | Registered taxable supplier | Outward supplies | 10th of the month succeeding the tax period |

| 2 | GSTR-2 | Registered taxable recipient | Inward supplies /Purchases | 15th of the month succeeding the tax period |

| 3 | GSTR-3 | Registered taxable person | Outward supplies , inward supplies, ITC availed, tax payable, tax paid and other particulars as prescribed | 20th of the month succeeding the tax period |

| 4 | GSTR-4 | Composition supplier | Outward supplies, inward supplies | 18th of the month succeeding the quarter |

| 5 | GSTR-5 | Non-resident person | Outward supplies, inward supplies | 20th of the month succeeding tax period & within 7 days after expiry of registration |

| 6 | GSTR -6 | Input service distributor | details of tax invoices on which credit has been received | 13th of the month succeeding the tax period |

| 7 | GSTR-7 | Tax deductor | Details of tax deducted | 10th of the month succeeding the month of deduction |

| 8 | GSTR-8 | E commerce operator/tax collector | Details of tax collected. | 10th of the month succeeding the tax period |

| 9 | GSTR-9 | Registered Taxable Persons | Annual Return | 31st December of the next Financial Year] |

| 10 | GSTR 9A | Taxable Person paying tax u/s 8 (Compounding Taxable Person) | Annual Return | 31st December of the next Financial Year] |

| 11 | GSTR 9B | Registered Taxable Person (if Turnover Exceeds 1Crore) | Audit Report with Reconciliation Statement | 31st December of the next Financial Year |

| 12 | GSTR 10 | Taxable person whose registration has been surrendered or cancelled | Final return | within three months of the date of cancellation or date of cancellation order, whichever is later |

| 13 | GSTR 11 | Persons having Unique Identity Number and Claiming Refund | Details of inward supplies | 28th of the month following the month for which statement is filed |

Read also GST Return filing Process in India

Free Education Guide on Goods & Service Tax (GST)