UDIN: An Advanced Solution for Document Verification issued by Chartered Accountant

Video Explanation by CA Satbir Singh in Hindi on UDIN system for CAs for Document Verification

What is Unique Document Identification Number (UDIN)?

Unique Document Identification Number (UDIN) is a unique number, which will be generated by the system for every document certified/ attested by a Chartered Accountant and registered with the UDIN portal available at https://udin.icai.org/.

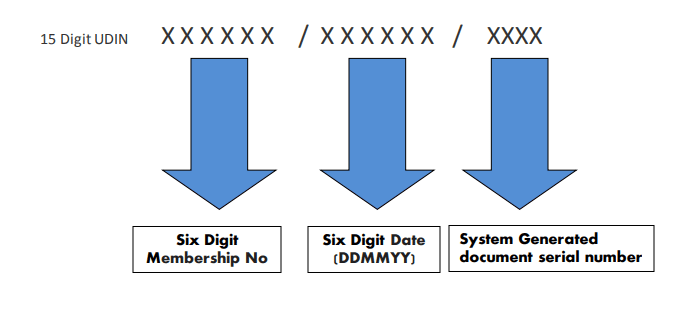

What is the Algorithm of UDIN?

Algorithm of UDIN comprises of the following:

1. The Membership Number of the Member attesting the document/ certificate.

2. The Date (dd/mm/yy) when certificate is issued.

3. The Document Serial Number allotted automatically by system.

Why UDIN?

It has been noticed that financial statements and documents were being certified/ attested by third persons, in lieu of Chartered Accountants. As these statements are being relied upon by the authorities as true statements and certificates, UDIN can be generated by a practicing CA by registering his/her documents/ certificates on UDIN Portal for verification.

Who can generate UDIN?

A practising Chartered Accountant can generate a UDIN for certificate/ document attested by him either in individual capacity or as a partner.

Whether UDIN is mandatory for the CA members of ICAI for each certification done?

At present, this facility is recommendatory. But ICAI is mulling to make the same compulsory in near future, so as to curb the menace of fake or forged documents.

What is the link to crosscheck whether the certificate number so indicated is valid?

The Certificate Number can be cross checked at https://udin.icai.org?mode=searchudin

How many UDINs can be generated by a CA? Is there any limit?

There is no restriction on the number of UDINs to be generated by a CA.

How to create an account on the UDIN portal?

To register at UDIN portal, please take the following steps:

Step 1: Enter the homepage https://udin.icai.org

Step 2: Click button “For first time sign up, click here”

Step 3: Enter your six-digit Membership No., Date of Birth and Date of Enrollment, and click the “Send OTP”.

An OTP will be sent to you at the mobile and email, as registered with the ICAI.

Step 4: Enter OTP received and click “Continue”, you will receive username and system generated password at the mobile and email, as registered with the ICAI.

How to Sign in

Go to the link https://udin.icai.org/?mode=login and Enter your Membership No, Password and click “Login”

Should the password be changed after login for safety?

The password generated is encrypted to ensure its appropriate safety. However, Members may change the password at any time. “Change Password” menu can be used to change the password.

✓ Sign in.

✓ Under “Sign-in”, select “Change

Password” menu.

✓ Enter your current Password.

✓ Enter your new password, then click send OTP. You will receive an OTP on your mobile and email, as registered with the ICAI.

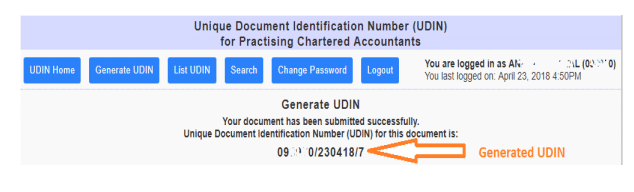

How to generate a Unique Document Identification Number (UDIN)?

✓ After login, click “Generate UDIN”

✓ Enter details such as, your Client Reference Code/Number, Document Issued, Document Description, Date of Document, Keywords/Values (minimum three) with in the document and click the button “Send OTP”. Firm Registration Number (FRN) is Optional.

✓ An OTP will be sent to you at the mobile and email, as registered with the ICAI.

✓ Enter OTP received and click the button “Preview”. You will see the details you have entered for generating the UDIN.

✓ If there is any change in the content, you should click the button “Back” or else click the button “Submit”

✓ A UDIN will be generated and you can use that UDIN on the document for which it has been generated

UDIN that have been generated would be displayed as watermarked on document(s) else the UDIN can be mentioned on the document(s) using a pen. “List UDIN” menu can be used to print the UDIN.

Can one see the various certificate numbers generated?

Yes, one can see and search the various certificates number generated using the search option

Is any modification possible in case incorrect information such as client reference code/number, Document Issued Under, Document Description, Date of Document, Keywords within the document, etc., has been submitted?

No change is possible in the data already registered by a Chartered Accountant in the online system. Therefore, members are requested to thoroughly check the details in preview option before submission of their application.

Information filled in can be edited/ modified any number of times before the submission.

But once it is submitted, it cannot be edited.

Can a Certificate number once generated be revoked or cancelled?

The UDIN once generated can be withdrawn or cancelled with narration.

Hence if any user search for this UDIN, appropriate narration indicated by Member with the date of revoke will be displayed for reference.

What is the validity of a UDIN on the portal for viewing by a third party?

As of now, there is no time limit.

Is UDIN mandatorily required to be registered for the search?

Yes, UDIN will be available for search by the end user only after registration.

What are the key values and are they necessary?

While registering the certificate for generation of UDIN, the member has to compulsorily provide Key values (minimum three and maximum five), which are found in the document or certificate generated.

Key values can be any financial figure extracted from the attested statement or certificate such as

- Turnover

- Net profit,

- Utilization amount,

- Import amount,

- Export amount,

- Duty refund,

- Refund,

- Net worth,

- Revenue,

- Input tax cred

- Loan amount,

- Total Assets,

- Net owned funds,

- Profitability,

- Capital To Risk Asset Ratio (CRAR),

- Statutory Liquidity Ratio,

- Gross fixed assets,

- Net loss,

- Misc. expenditure,

- Total capital investment,

- Sanction amount,

- Other (please specify any key words), etc

What happens if while registering on UDIN Portal, the information is not accepted or the password is not sent?

Credentials do not match with the database as maintained by the regional offices. Probably, the database maintained does not have the correct email ID or mobile number, or the regional offices may have entered the same wrongly. For example, entering multiple email IDs in one field, providing space before the email IDs, etc. You may reach the PDC Department at (011) 3011 0444, 0444 or by writing to udin@icai.org. For all issues relating to the data regarding enrolment dates, DOB, email IDs, phone number corrections, etc., please get in touch with the respective

regional offices.

Western Region

ICAI Tower, C-40, G-Block, Bandra Kurla Complex, Bandra (E)

MUMBAI – 400 051

Phone : [+91] (22) 3367 1400 / 1500

[+91] (22) 3367 1462, 463

E-mail: wro@icai.in;wirc@icai.in;raviarora@icai.in

Website: http://www.wirc-icai.org

Northern Region

ICAI Bhawan, 52-53-54, Institutional Area, Vishwas Nagar, Shahdara, Near

Karkardooma Court

DELHI – 110 032

Phone: [+91] (11) 3989 3990, 3021 0600

[+91] (11) 3021 0636, 629

Email: nro@icai.in;nirc@icai.in;shivam@icai.in

Website: http://www.nirc-icai.org

Central Region

ICAI Bhawan, Plot No.9, Block No.A-1, Lakhanpur

Kanpur 208024 (UP)

Phone: [+91] (512) 3092600

[+91] (512) 3092634, 681

Email: cro@icai.in;circ@icai.in;skgarg@icai.in

Website: http://www.circ-icai.org

Eastern Region

,

ICAI Bhawan, 382/A, Prantik Pally

Rajdanga, (Near Acropolis Mall & Garden High School), Kasba, KOLKATA – 700 107

Phone: [+91] (33) 3084 0210 / 03

[+91] (33) 3084 0296, 289

Email: ero@icai.in;eirc@icai.in;alokray@icai.in

Website: http://www.eirc-icai.org

Southern Region

ICAI Bhawan, 122, Mahatma Gandhi Road

Post Box No. 3314, Nungambakkam

CHENNAI – 600 034

Phone: [+91] (44) 3989 3989, 3021 0300

[+91] (44) 3021 0355, 391

Email: sro@icai.in;sirc@icai.in; giridharan@icai.in

Website: http://www.sircoficai.org

Is online generation of UID number is mandatory? Or, if the UID number is generated offline, can the same be entered in back date?

Yes, it is mandatory that the numbers to be generated online only

How will the UDIN appear on the documents?

UDIN that have been generated would be displayed as watermarked on document(s) else the UDIN can be mentioned on the document(s) using a pen. “List UDIN” menu can be used to print the UDIN.

Can UDIN be generated as per the category of the area of Certificate?

Yes, UDIN can be generated in the specific area of certificate, like

- Goods & Service Tax Act,

- banks,

- Companies Act,

- Income-tax Act,

- finance and capital market,

- public finance and

- government accounting, etc,.

Log Out

Click logout, when you wish to leave this application. Please note, there is a provision of automatic logout, if there is no activity for five minutes.

For any assistance/ clarification, members may call us at (011) 30110444 or email at udin@icai.in.