Person Competent to Verify IT Return

Register as Person Competent to Verify in e-Filing on portal www.incometaxindiaefiling.gov.in

As per section 140 of Income Tax Act 1961, where the individual (assessee) is mentally incapacitated from attending to his affairs, his guardian or any other person competent to act on his behalf can verify the return of income. An Individual must register on behalf of a mentally incapacitated individual in e-Filing application in order to avail the services like filing of returns and other functionalities.

Pre-requisites to register as Person Competent to Verify

Competent Person’s PAN should be registered in the e-Filing portal (www.incometaxindiaefiling.gov.in)

Mentally incapacitated individual may be registered.

This functionality is provided for Individual user only.

Steps involved in Register as Person Competent to Verify

Step 1 – Login to e-Filing portal using Competent Person’s Credentials

Step 2 – My Account Register as Person Competent to Verify

Step 3 – Enter the details of Mentally incapacitated individual

PAN

Date of Birth (DD/MM/YYYY)

Surname Middle Name

First Name

Step 4 – Select the files to upload

Step 5 – Attach a Zip/PDF File with the below scanned documents

Copy of PAN card of the incapacitated

Self-attested PAN card copy

Certificate issued by District Committee headed by District Collector.

Step 6 – Click Submit

Approval Process

Step 1 – ‘Register as Person Competent to Verify’ request will be sent to the e-Filing Administrator.

Step 2 – The e-Filing Administrator will verify the request and approve / reject as applicable based on the documents uploaded.

Step 3 – An e-mail is sent to the registered e-mail ID with the details of approval / Rejection.

Key Points to be noted:

Documents in regional language should be translated to Hindi or English. The translated document should be notarized (Both the original and translated document should be uploaded).

The uploaded documents should be scanned in ZIP / PDF format with 300 dpi.

The zip file attachment should not exceed 50Mb.

Once the mentally incapacitated PAN is added by Person Competent to verify and approved by e-Filing admin, the mentally incapacitated User ID shall be deactivated in e-Filing portal

If a mentally incapacitated PAN is not registered and the e-Filing admin has approved the Person Competent to verify for such PAN, then that PAN cannot be further registered in e-Filing portal.

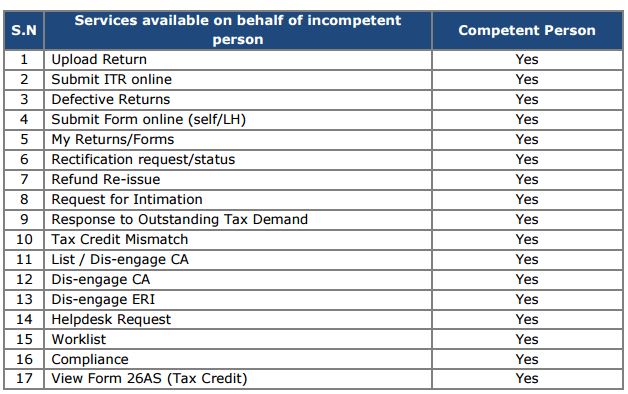

Person competent to Verify Functionalities